ICYMI: Digital Liberty Hosts Event About AI and ML in the Financial Sector

Digital Liberty and Americans for Tax Reform held an event this week entitled “Using Artificial Intelligence and Machine Learning to Expand Access to Credit and Financial Services Innovation” to discuss how AI & ML will be used in the financial sector in the future and what are some policies we should look at to keep these technologies from creating counterproductive results.

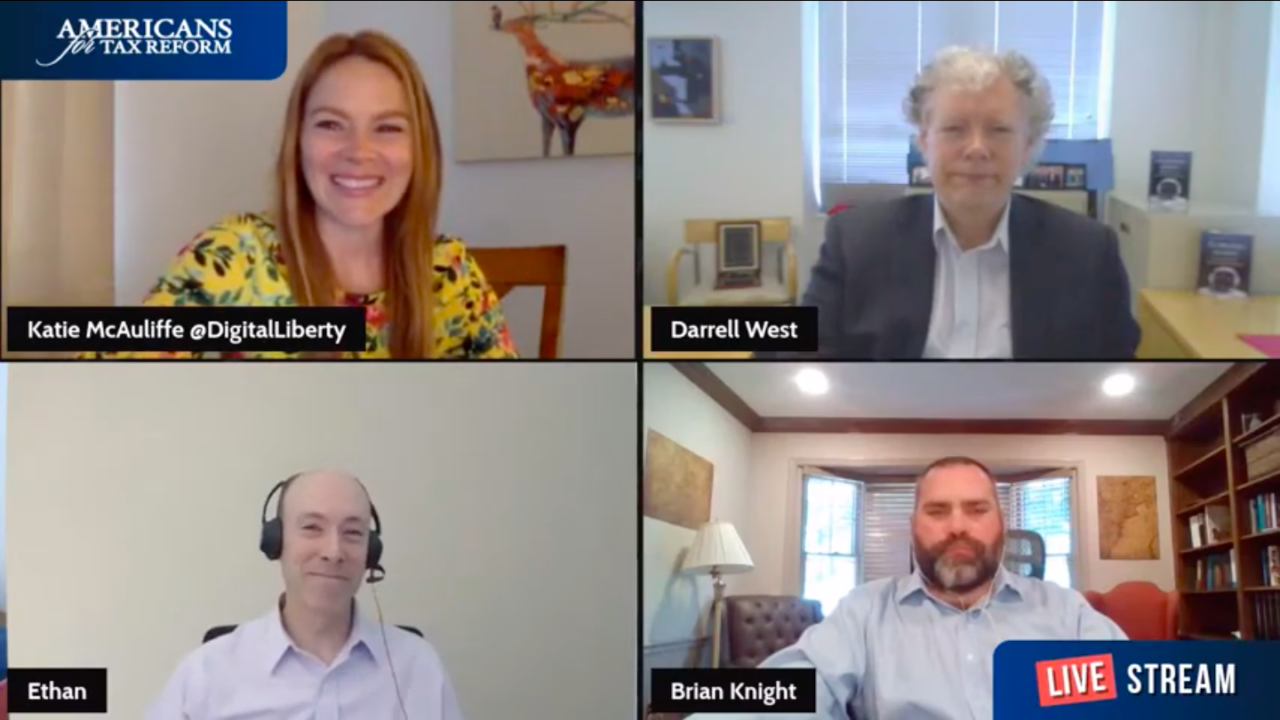

The panel was moderated by Digital Liberty Executive Director Katie McAuliffe and featured 3 distinguished panelists:

- Ethan Dornhelm, Vice President of FICO Scores and Predictive Analytics

- Darrell M. West, Vice President of the Brookings Institution and Senior Fellow of the Center for Technology Innovation

- Brian Knight, Sr., Director of Innovation and Governance at the Mercatus Center

It is without a doubt that we will see use the artificial intelligence and machine learning be integrated into more and more industries in the future. So what does this path look like? The Federal Trade Commission recently released new guidelines about the use of AI by industry. Our panelists saw these guidelines as the Commission opening the door to make many of the regulations that apply to brick and mortar stores apply to the digital space as well.

With this technology being incorporated more and more, our panel also discussed what are the implications for consumer privacy will be. The power of AI will be used to analyze massive quantities of data given by consumers. Our panelists agreed that this data should be anonymized and consumers should be made aware of how that data is going to be used. One idea offered is that the permissions consumers give to websites to use their data should expire and consumers should have to reauthorize them after a certain amount of time. The panelists agreed that if the industry doesn’t get together to form their own best practices, government will.

Focusing on the issue of credit, the panel discussed the potential of using alternative data to expand credit access to millions of Americans. Alternative data means anything that is not in the files that credit bureaus report. Data like utility bills payments, rental payment, or even paying your cellphone bills are forms of data that aren’t being reported to credit bureaus, yet demonstrate that a person is behaving financially responsible. Using this data could give millions of consumers the opportunities and abilities that come with having credit history.

You can watch the even in full by clicking HERE